Services

Facilities Available

RTGS

NEFT

Demand Drafts

Pay Orders

Locker Facility

Nomination Facility

IFSC Code has been allotted

Your deposits are Insured

Rate of Interest on Loans & Advances

| Loan Type | Rate of Interest (%) |

|---|---|

| Salary Loan | 14.00% |

| Vehicle Loan | 9.90% |

| Cash Credit / Overdraft | 13.50% |

| Housing Loan | 9.75% |

| Gold Loan | 9.70% |

| Mortgage Loan | 13.50% |

| Unsecured Loan | 14.00% |

Vision: How we deliver our promise to members

- A trusted service provider to the growth of our customer.

- To be an icon of service excellence of the bank

Mission: What we do

- We grow and prosper together with our customers, by providing services of greater value to them

- We aim to maximize our shareholder’s value through the continuous growth of our business

Values: Principles

- Transparent-Open and clear communication in everything we do

- Accessible – Easy to reach, approachable, and always ready to support

- Teamwork- Work as a team to reach our goal

- Accountability- My actions are my responsibilities

- Integrity-Loyalty and honesty

- Customer Oriented-We commit to provide best service

Services

1. Savings Account

Save today, for a better tomorrow

A savings account is a financial tool that allows you to securely deposit and store money while earning interest. We offer competitive savings account interest rates, ensuring your money grows effortlessly. Enjoy the flexibility to manage your savings bank account with the bank.

A Savings account is a secure deposit account offered by the bank that allows you to save the money while earning interest. It provides you easy access to funds for daily expenses and transactions, while offering nominal growth on the balance through interest.

Savings Account Eligibility:

Resident of Indian above 18 years of age (with valid ID and address proof)

Documents Required for Opening Savings Account:

- Minimal documentation: Just provide your PAN card and Aadhar card.

- (Aadhar and PAN should be linked)

- 3 Passport Size Photos latest

Interest Rate on Savings Account:

- Currently the interest rate on Savings Account is 3.%

- Interest on Savings Account is automatically computed based on the banks offered and your maintained monthly balance

- The interest is calculated daily on the maintained balance and the interest is credited on half Yearly and Yearly basis to your account.

2.Current Account

Save today, for a better tomorrow

SMVS Bank is a fast-growing Co-operative banking sector which provides personalized business banking solutions. SMVS Bank is a Co-operative banking sector, and it offers customized current account banking products to businesses as well as individuals. A current account is a demand deposit account which includes deposits, withdrawals, and business transactions. A current account is meant for the enterprise or business professionals who deal with large transactions on a daily basis. The current account allows the business entities to carry out unlimited transactions without any limit, subject to a banking transaction tax if any levied by the government.

Facilities:

The following are some of the important features and benefits of opening a current account with SMVS Bank.

- SMVS Bank, provide businesses with any kind of banking solutions as per their various requirements.

- Free cash deposits and free cheque payments and collections can be made with the SMVS bank current accounts

- Current accounts are non-interest bearing accounts and need a higher minimum balance to be maintained as compared to the savings account.

- Multi-city cheque books are provided with account opening, and the nomination facility is also accessible

Eligibility Criteria:

- Resident Individual

- Hindu Undivided Family (HUF)

- Sole Proprietorship Firm

- Partnership Firm

- Private or Limited company

- Limited Liability Partnership

- Trust/ Association/ Club/ Society

Documents Required:

The below given are the documents (KYC) need to be furnished at the time of opening a current account in SMVS Bank.

For Individuals:

- Prescribed Application Form

- Proof of Identity: PAN Card, Aadhar Card, Driving License, Voter ID Card, etc.

- Proof of Address: Aadhar Card, Valid Passport, Utility bill, Property tax bill, etc.

- Latest Passport size colour photos

For Partnership Firm:

- Identity Proof as per KYC norms: PAN Card, Aadhar Card, Driving License, Voter ID Card, etc.

- Address Proof as per KYC norms: Aadhar Card, Valid Passport, Utility bill, Property tax bill, Telephone bill, etc.

- Partnership Registration Certificate (in the case of a registered concern).

- Partnership Deed

- Passport-size photographs of the partners.

For Public/Private Limited Companies:

- Application form in the prescribed form.

- Memorandum and Articles of Association.

- Identity Proof: PAN Card, Aadhar Card, Driving License, Voter ID Card, et

- Address Proof: Aadhar Card, Valid Passport, Utility bill, Property tax bill, Telephone bill, etc.

- Commencement of Business Certificate.

- Incorporation and Board Resolution Certificate.

- Registration certificate

- License Certificate issued by the Municipal Authorities under Shop & Establishment Act.

- Passport-size photographs .

Trust/Society/Associations and Club:

- Constitution document of the entity

- The updated directors list to be submitted.

- Proof of Identity: PAN Card (entity)

- Proof of Address: Aadhar of the sole proprietor or entity, Valid Passport of the sole proprietor, etc.

Limited Liability Partnership (LLP)

- Power of Attorney (POA)

- Registration Certificate issued by Registrar of LLP.

- Identity Proof of POA holders: PAN Card of the entity.

- Address Proof: Aadhar Card of the sole proprietor/ entity, Valid Passport, etc.

- Latest Two passport size colour photographs.

- LLP agreement.

- Designated partners updated list.

3.Fixed Deposits

The reasons behind the growing popularity of fixed deposits are multifaceted. A major key incentive is the guarantee of fixed returns, which proves to be invaluable in meeting the risks that often accompany other financial options. This investment option is highly favored by those who value reliability and safety over high-risk avenues. Additionally, they act as a stepping-stone towards disciplined investing, allowing investors to mitigate their short-term goals with ease.

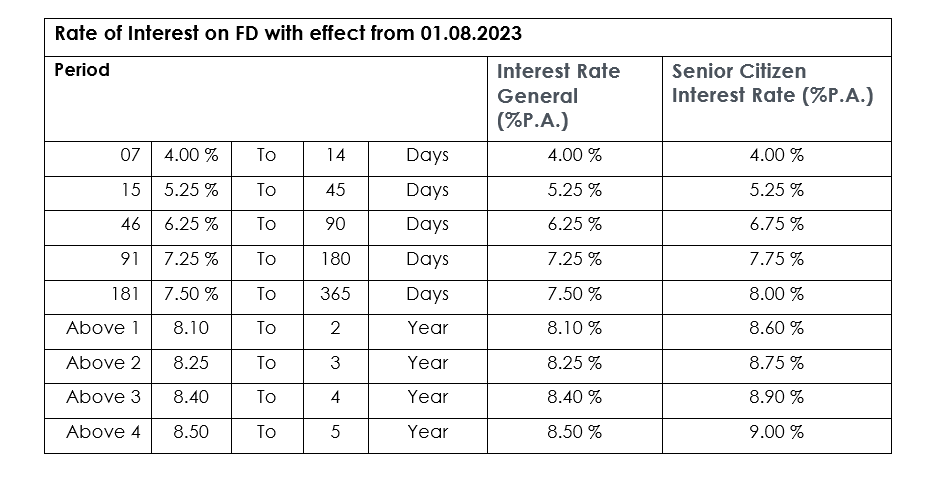

A low initial deposit requirement makes this instrument accessible to a wide range of investors, from beginners to seasoned savers. The investment tenure further increases the appeal of fixed deposits. Ranging from a short span of seven days to a longer investment horizon of 5 years, these distinct tenures help meet diverse financial goals. Moreover, senior citizens are provided preferential treatment on such accounts. They are offered an additional interest rate of 0.50 per cent. Note that such rates are over and above the regular fixed deposit interest rate.

FD interest frequency and maturity instructions –

The FD account allows investors to select the regular FD interest pay out option. This means they can choose to receive regular income through monthly or quarterly of Half yearly or Yearly pay outs, permitting them to mitigate their regular financial commitments with ease. For those looking for compounding returns, the reinvestment option with quarterly compounding interest serves as strategic option.

Moreover, SMVS Bank’s FD account goes beyond conventional offerings by introducing the facility of sweep-in and sweep-out. This feature allows investors to prematurely withdraw the required amount through their FD account via the sweep-in facility. Additionally, the deposit account extends the possibility of obtaining an overdraft option, offering up to 80 per cent of the principal FD amount. This feature also is considered invaluable during financial emergencies.

For those concerned regarding tracking their FD maturity, the SMVS Bank FD accounts eliminates this burden with its automatic renewal facility. This means that once your FD matures, it automatically will be renewed at the existing interest rates, permitting your wealth to continue growing without any interruptions. With this feature, SMVS Bank provides a hassle-free and seamless experience to their customers.

Basically we have two types of deposits,

- Term Deposit-Which is simple Interest

- Special Term Deposit: Which is Compounding Interest

Interest Rates on Fixed Deposits

Key features and benefits of a fixed deposit account at SMVS BANK

- Flexibility to choose a suitable duration

- Versatile interest pay-outs

- Liquidity benefit

- Higher rate of interest

- Auto-renewal of policy

- Advance on Fixed deposits

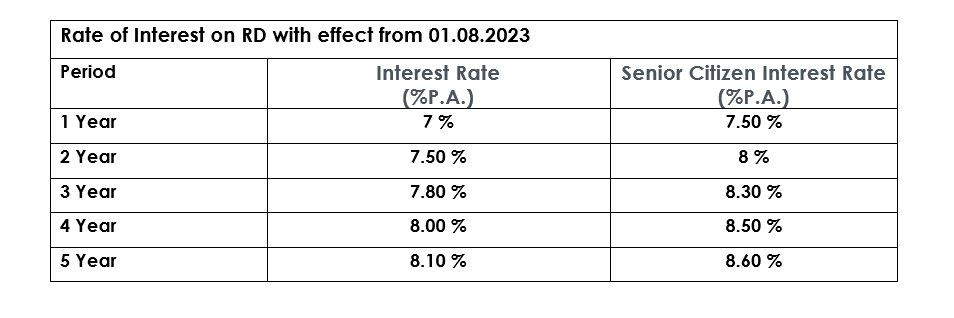

Recurring Deposit (RD)

At SMVS BANK, we continuously strive to provide you with best-in-class products with a superior service excellence. SMVS BANK RD has higher potential for earning, as we provide the best interest rates in the banking sector, Recurring Deposits offer investors the opportunity to deposit a set amount each month. RD provides customers with convenience and complete flexibility by allowing them to deposit funds based on availability of the amount.

Interest Rates on Recurring Deposits

Note:

- Senior Citizen rates are applicable only for Resident Individual deposits

- Rates are subject to change from time to time at the sole discretion of SMVS BANK

- If the Recurring Deposit is closed before completing the original term of the deposit, interest will be paid at the rate applicable on the date of opening of Recurring Deposit, for the period for which the deposit has remained with the Bank. Additionally, a penalty of 1 % will also be charged.

LOANS

1. MTL (U) Loan:

A MTL (U) Loan is an unsecured loan where you can borrow funds without having to pledge any form of security. The approval for your SMVS Bank unsecured Loan will depend on the 2 compulsory share holder’s sureties

Benefits of MTL (U) Loan:

- No Collateral required

- Quick access to funds

Eligibility: Minimum entry age is 18 years and Maximum exit age is 70 years.

Quantum of Loan: Rs 50,000/-

MTL (U) Loan Interest Rates and Charges:

- Rate of Interest: 14 %

- Loan Processing Charges: 1 % of the loan amount + GST 18 %

- Stamp Duty: At actuals (Per applicable state laws)

- Max Loan Period: 12/24/36 Months

2.Salary Loan:

An education loan is not just financial aid; it’s a bridge between your aspirations and the realm of possibilities. At its heart, an education loan is a lifeline that empowers students to pursue their dreams of higher education without the burden of immediate financial constraints.

Whether you are envisioning a degree that opens doors to new horizons or seeking professional skill enhancement, a salary loan from SMVS Bank is your partner in turning ambitions into achievements. Our comprehensive education loan, with attractive rates and quick approvals, is designed to empower you on your journey to a brighter future.

A salary loan (sometimes called a personal loan against salary or payroll loan) is a short-term or medium-term loan that is given to salaried individuals, usually based on their monthly income and repayment capacity

Eligibility: Minimum entry age is 18 years and Maximum exit age is 60 years.

Quantum of Loan: 10 times of take home salary and maximum Rs 3,00,000/- whichever is less

Repayment Methods: Repayment period of up to 12/24/36 months in case of staff 5 Years or before retirement whichever is less maximum age up to 60 years.

Security:

- Salary Certificate

- Undertaking by the drawing officer for deduction of loan installments out of the salary of the applicant letter from drawing officer.

- Two Guarantors of having means equivalent to that of the loan amount.

Salary Loan Interest Rates and Charges:

- Rate of Interest: 14 %

- Stamp duty-As per actuals which are applicable in laws of the state

- Processing fees-1% of the loan amount + GST

- Shares-2.5 % of the loan amount

- Pre closure charges-NIL

- Max Loan Period: 36Months

3. Vehicle Loan

SMVS Bank offers the best deals for financing your car at lower interest rates and with minimal paperwork and quick disbursement.

The Vehicle Loan Interest Rate is 9.90%

Overview

The thrill of bringing your brand-new Vehicle to home is special. Vehicle has been the driver behind fulfilling the dreams of people to own vehicle. What if we told you that there was an easy, quick and seamless way to get your vehicle at SMVS BANK vehicle Loan is committed to making your vehicle buying experience smoother than ever. It provides 70 % on Ex show room financing on selected vehicles, pocket-friendly Monthly Interest, and flexible repayments

Flexible repayments

SMVS BANK comes with flexible repayment tenures tailored to your needs at the most affordable Vehicle Loan rates. You get to select the repayment tenure from 12 to 60 months along with quick and easy processing and approval.

Eligibility:

Resident of Indian above 18 years of age (with valid ID and address proof)

Documentation:

- Aadhar Card and Pan Card

- Latest 3 Years IT Returns (With Balance sheet and P&L)

- Latest 3 Photos

Fees and Charges

- Application charges-₹118 per case (charges NOT to be refunded in case of case cancellation.)

- Stamp duty-As per actuals which are applicable in laws of the state

- Processing fees-1% of the loan amount + GST

- Shares-2.5 % of the loan amount

- Pre closure charges-NIL

Repayment

Vehicle Type | Months |

2 Wheeler | 36 Months |

3 Wheeler | 36 Months |

4 Wheelers | 84 Months |

6//10/12 Wheelers | 96 Months |

Security: 1. Hypothecation of vehicle purchased out of Bank’s finance

- Bank’s lien to be noted with the Road Transport authorities

Insurance: Vehicle should be comprehensively insured by you covering all risks and duly assigned in favor if Sir M Vishweshwaraiah Sahakar Bank Niyamitha Kalaburagi

4. Gold Loan:

Fulfill your needs with SMVS Bank Gold Loan which allows you to get funds in 1-2 hour, Whatever your need may be – education, business expansion, personal requirement, medical crisis or any other specified end-use, our Loan against Gold is all you need.

In volatile times and during a contingency you can take a Loan on Gold, for any use other than to purchase jewellery.

Gold is a valuable asset, and with it comes surety and stability, so why not let it work for you? With minimal documentation and quick disbursal, a Gold Loan is a seamless solution. You can avail a Loan against Gold at any time.

Fees and Charges:

- Gold Loan Repayment: Monthly Payment /Bullet Payment

Ø Gold Loan Interest: 9.75 % P.A and 2 % Penal Interest

- Gold Loan Tenure : 1 Year

- Gold Loan Processing : Fastest Turnournd, Enjoy simple documentation and speedy disbursals

- Loan processing charges: 0.5 % of the loan amount + GST 18 %

- Loan to value ratio: 75 %

- Valuation Charges: Rs 500/-

Quantum of Loan: Maximum amount of loan is Rs 25 Lakhs

Margin: 25% of valuation Amount

5. Housing Loan:

At SMVS Bank, we understand that a home loan is not just a financial transaction. It is much more than that. It is a warm little corner of the world that is yours, tailored to your tastes and needs. It is the place where you celebrate the joys, deal with the sorrows, and enjoy the journey called life. There is no place like home, and with SMVS Bank Home Loans, you can gather hopes, achieve your dreams, and create memories in your own space.

List of Property Documents:

- Title deeds of the property and link documents

- NA order copy with Layout Map

- E-Khata

- Tax Paid Receipts

- Construction Permission

- EC for last 25 Years

- Processing fees and Charges:

- Share Fees: 2.5% of the loan amount + GST 18%

- Loan Processing Charges: 1% of the loan amount + GSt 18 %

C.Building Fund: Rs 5000 (In case of the first time borrower)

Housing Loan Interest Rate:

The Bank offers home loan interest rates 9.75*% p.a and Penal Interest at rate 2%

Loan Amount and Tenure:

At SMVS bank we offer maximum housing loan up to of Rs 25,00,000/-and Maximum tenure is up to 25 Years

Moratorium Period: 18/24 months from the date of first disbursement

IT Returns: For the last 3 years (With balance sheet and P& L if applicable)

Insurance: Property should be comprehensively insured by you for an amount not less than the value of the property (less cost of land) covering all risks and duly assigned in favor of Sir M Vishweshwaraiah Sahakar Bank Niyamitha Kalaburagi

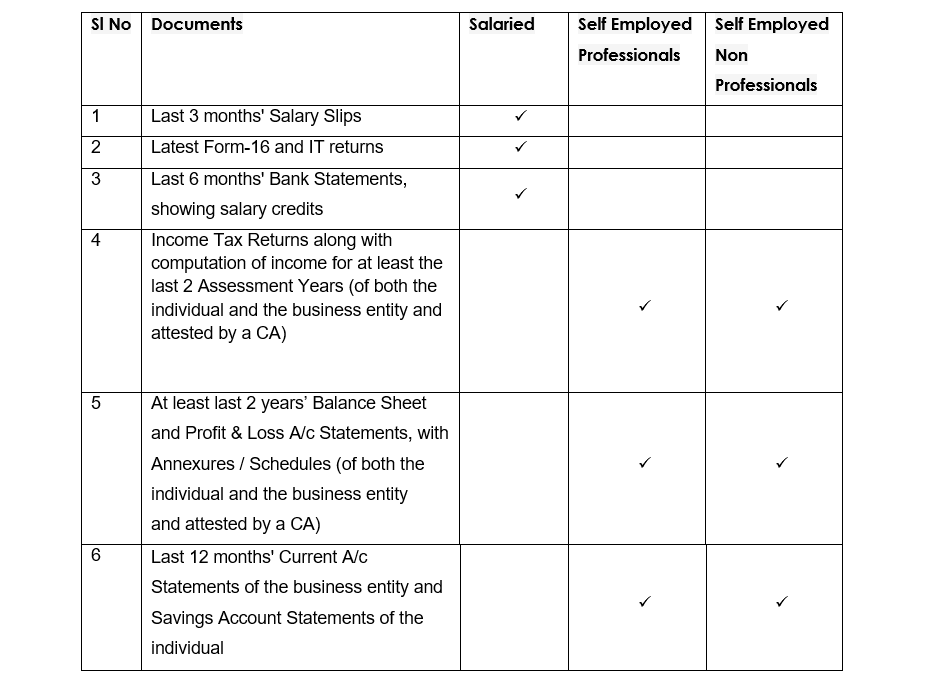

2) – Proof of Income

3)-List of Property Documents:

- Title deeds of the property and link documents

- NA order copy with Layout Map

- E-Khata

- Tax Paid Receipts

- Construction Permission

- EC for last 25 Years

Processing fees and Charges:

- Share Fees: 2.5% of the loan amount + GST 18%

- Loan Processing Charges: 1% of the loan amount + GSt 18 %

- C.Building Fund: Rs 5000 (In case of the first time borrower)

Housing Loan Interest Rate:

The Bank offers home loan interest rates 9.75*% p.a and Penal Interest at rate 2%

Loan Amount and Tenure:

At SMVS bank we offer maximum housing loan up to of Rs 25,00,000/-and Maximum tenure is up to 20 Years

6- MTL (U) Loan:

SMVS Bank offers the ease of using your residential or commercial property as collateral to get a Loan against the Property. You can use the funds for various expenses like a wedding, business expansion, medical emergencies or your child’s education. With SMVS Bank Loan against Property, you get financial assistance with flexible repayment schedules and attractive interest rates. By pledging your property, you can achieve your financial goals faster, more easily and with complete confidence.

Rate of Interest: 13.5 %

Stamp duty-As per actuals which are applicable in laws of the state

Processing fees-1% of the loan amount + GST

Shares-2.5 % of the loan amount

Pre closure charges-NIL

Repayment: 5/10/15/20 years from the date of sanction maximum 75 age (in case of staff 60 age or before retirement whichever is less)

Margin: Maximum up to 75 to 80 % of valuation of the property

Guarantors: Two Guarantors of having means equivalent to that of the loan amount.

Insurance: Property insurance should be comprehensively insured by the borrower for an amount not less than the value of the property (less cot of land) covering all risk and duly assigned in favor of Sir m Vishweshwaraiah Sahakar Bank Niyamitha Kalaburagi

7- Cash Credit/Over Draft Loan:

Overdraft facility offers a credit line for respite against temporary cash flow problems. The funds can be withdrawn multiple times, as per the assigned credit limit. It is a type of short-term loan to be repaid in defined tenure, which is usually 12 months that can be renewed periodically for continued usage.

The overdraft limit can also be extended, based on your creditworthiness, financial profile and existing relationship with the respective bank

The interest rate is charged only on the utilized amount from the total sanctioned credit limit.

Features of Overdraft Facility

Approved Credit Limit: Overdraft is issued over a predetermined limit and this limit shall vary from lender to lender.

Interest Rate: The interest rate is charged only on the amount of funds used. It is calculated on a daily basis and it is billed to the account at month-end. If you default on paying the overdraft as per the set schedule, the interest amount will be added to the principal amount at the month-end and then interest will be calculated on the new principal amount.

Minimum Monthly Payment: Overdraft has no minimum monthly repayment; however, the amount you owe should be within the overdraft limit. You should not delay overdraft repayment for long, as it affects your CIBIL score.

Rate of Interest: 13.5 %

Stamp duty-As per actuals which are applicable in laws of the state

Processing fees-1% of the loan amount + GST

Shares-2.5 % of the loan amount

Pre closure charges-NIL

Loan Renewal: Further extension subjected to the renewal upon a review.

Insurance: Property insurance should be comprehensively insured by the borrower for an amount not less than the value of the property (less cot of land) covering all risk and duly assigned in favor of Sir m Vishweshwaraiah Sahakar Bank Niyamitha Kalaburagi

Loan Processing fees:

SL NO | LAON AMOUNT | % |

1 | Rs 1 to 25,000 | 0.28% OF LOAN AMOUNT + 18 % GST |

2 | Rs 25001 to 5,00,000 | 0.26% OF LOAN AMOUNT + 18 % GST |

3 | Rs 5,00,001 to 10,00,000 | 0.25% OF LOAN AMOUNT + 18 % GST |

4 | Rs 10,00,001 to 20,00,000 | 0.24% OF LOAN AMOUNT + 18 % GST |

5 | Rs 20,00,001 to 30,00,000 | 0.23% OF LOAN AMOUNT + 18 % GST |

6 | Rs 30,00,001 to 40,00,000 | 0.22% OF LOAN AMOUNT + 18 % GST |

7 | Rs 40,00,001 to 50,00,000 | 0.21% OF LOAN AMOUNT + 18 % GST |

8 | Above 50,00,000 | 0.20% OF LOAN AMOUNT + 18 % GST |